Retail

Recent Transactions Include:

Central Buildings, Guildford

ON THE MARKET: prime freehold mixed-use investment with value-add potential in one of London’s affluent commuter towns. Get in touch for more details.

121-159 Station Road East, Oxted, Surrey

UNDER OFFER: prime freehold mixed-use investment anchored by Waitrose in one of London’s affluent commuter towns. Get in touch for more details.

Greyhound House, 23-24 George Street, Richmond

A prime freehold mixed-use investment in one of London’s wealthiest suburbs. Griffiths Eccles successfully sold this asset for clients of DTZ Investment Management.

Regent Square House Royal Leamington Spa

ON THE MARKET – Landmark freehold reversionary mixed-use property in the heart of ‘Silicon Spa’s’ gaming cluster. Get in touch for more details.

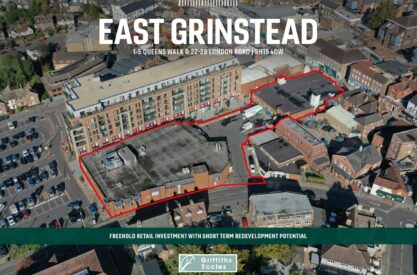

Queens Walk & London Road, East Grinstead

Freehold retail investment with short term redevelopment potential. Griffiths Eccles successfully sold the asset for clients of CBRE Investment Management.

Acorn Portfolio

A prime mixed-use portfolio of 5 assets. 69% of income secured for over 10 years and subject to index linked rent reviews. Portfolio WAULT 13.7 years. Griffiths Eccles successfully sold the assets for clients of CBRE Investment Management.

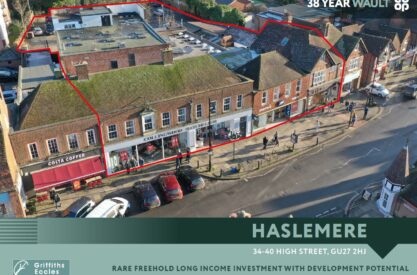

34-40 High Street, Haslemere

A rare freehold long income investment with future potential redevelopment potential. WAULT of 38 years. 79% of income secured to Co-Op for 48 years. Griffiths Eccles successfully sold the asset for clients of CBRE Investment Management.

Sainsbury’s, Chipping Norton, Oxfordshire

A prime freehold Sainsbury’s extending to 15,000 sq ft in the centre of the beautiful Cotswold town of Chipping Norton. Griffiths Eccles acquired this asset for a private investor.

99-101 London Road, Croydon, London

A Lidl supermarket for a further 26 years within index link reviews with local government offices above, on a Greater London site of 2.77 acres with future redevelopment potential. Griffiths Eccles acquired the asset for a family property company.